[wpcode id=”324″]

The Forex market is always moving somewhere in the world. But if traders don’t know the exact Forex market hours, they might miss good chances to trade.

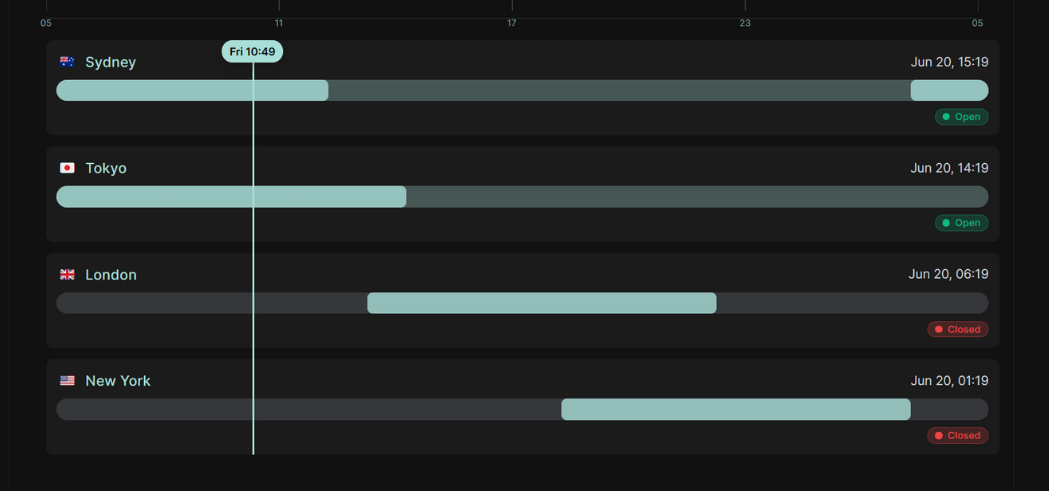

That’s why Forex Market Hours Live is helpful. It’s an easy-to-use forex market hours clock that shows when the major Forex trading sessions like Sydney, Tokyo (Asian), London, and New York are open or closed — all based on your local time. You don’t have to do any time math!

The tool also shows when sessions overlap, which is usually the best time to trade because the market is more active.

How to Use the Forex Market Hours Live Tool (Step-by-Step Guide)

Forex Market Hours Live is super simple to use, even if someone is new to Forex trading. Here’s how it works:

- See Your Current Time

Right at the top of the tool, your current time is shown. It automatically picks your timezone. But if you want, you can change the timezone from the dropdown on the right. - Check Which Markets Are Open

You’ll see four lines — one for Sydney, Tokyo, London, and New York. Each line shows if that market is:

– Open (green color or active bar)

– Closed (grey or red color)

– Overlapping with another session (this is a great time to trade) - Look at the Vertical Time Line

A straight vertical line moves along the chart. It shows the current time. So you can easily see which sessions are open right now. - Watch the Trading Volume

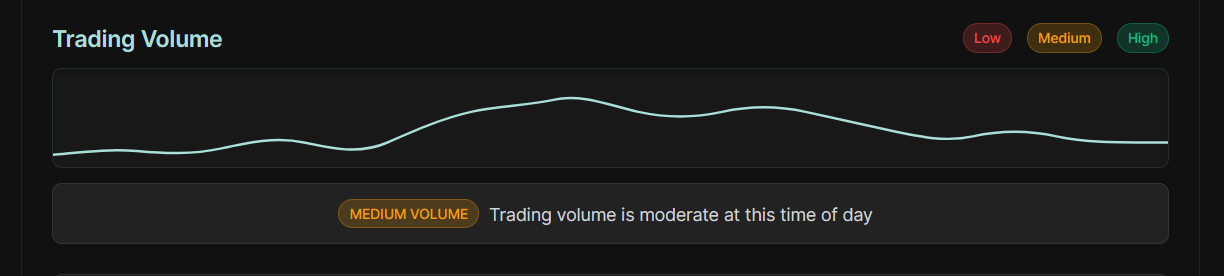

At the bottom of the tool, there’s a Trading Volume Graph. This shows how active the market is:

– Green area means high trading volume (market is busy)

– Yellow means medium volume

– Red means low volume (market is quiet) - Notice Daylight Saving Time (DST)

The tool also shows if Daylight Saving Time is active. This matters because in some countries, market hours change during DST. The tool handles this for you. - Real-Time Updates

The tool updates every minute. So the information is always live. You don’t need to refresh the page.

Convert Forex Market Times to Your Local Time

Forex is a global market. It runs 24 hours, Monday to Friday. But different countries have different time zones. This can be confusing.

With Forex Market Hours Live, there’s no need to worry. The tool automatically shows Forex market hours in your timezone.

If you’re in the United States, India, the United Kingdom, Australia, the United Arab Emirates, or anywhere else, the tool shows correct session times for your location. No more time conversions in your head!

Why It’s Useful:

- You know exactly when sessions open or close in your timezone

- You won’t miss overlap periods (best time to trade)

- It works well for people who travel or trade from different countries

- The tool also adjusts for Daylight Saving Time (DST)

This makes trading easier and more organized for everyone.

Forex Market Open and Close Times Explained

The Forex market is open 24 hours a day, but not all countries trade at the same time. The market follows four big sessions:

- Sydney Session

The first session opens each day.

– Summer: 9:00 PM to 5:00 AM UTC

– Winter: 10:00 PM to 6:00 AM UTC - Tokyo/Asian Session

Starts after Sydney and includes countries like Japan.

– Year-Round: 12:00 AM to 9:00 AM UTC - London Session

One of the busiest sessions.

– Summer: 7:00 AM to 3:00 PM UTC

– Winter: 8:00 AM to 4:00 PM UTC - New York Session

The final session of the day covered the US market.

– Summer: 12:00 PM to 9:00 PM UTC

– Winter: 1:00 PM to 10:00 PM UTC

The Forex market opens on Monday morning in Sydney and closes after the New York session ends on Saturday morning, depending on your timezone.

Quick Facts:

– Forex market is open 24 hours from Monday to Friday

– Weekend trading is mostly closed

– Timings may change during DST, and our tool adjusts automatically

What Are the Four Major Forex Sessions?

The Forex market is open 24 hours a day, but it’s divided into four main sessions. These sessions are based on the biggest financial cities in the world.

Knowing these sessions helps traders plan when to trade and understand when the market is active or quiet.

- Sydney Session

This is the first session to open after the weekend. It kicks off the trading week. It may be quieter than others but still offers good opportunities. - Tokyo/Asian Session

This is when the Asian markets are most active. Japan is a major player in global Forex, so this session can see good movement, especially for currencies like the Japanese Yen (JPY). - London Session

This is one of the busiest sessions. Many traders from Europe are active, and there is usually high trading volume. The British Pound (GBP) and Euro (EUR) see lots of action here. - New York Session

The last big session of the day. The US is a huge part of the Forex market. The US Dollar (USD) is involved in many trades. There’s also a strong overlap with the London session, which is the most active time.

When Do Forex Trading Sessions Overlap?

Overlaps happen when two big Forex markets are open at the same time. This is usually the best time to trade.

Why? Because:

- More traders are active

- There’s higher buying and selling

- Prices move more

- Spreads are usually lower

Main Overlap Periods:

Tokyo (Asian) – London Overlap

This overlap happens in the morning for Europe and during Asia’s trading hours. It’s a good time to trade Asian and European currency pairs.

London – New York Overlap

This is the most active time of the day. Many traders from Europe and America are online. Major pairs like EUR/USD, GBP/USD, and Gold often show big price moves.

Forex Market Hours Live makes it easy to see these overlapping periods with colored bars.

Forex Trading Volume by Time of Day

The amount of buying and selling in the Forex market changes throughout the day. This is called trading volume.

- During quiet times, prices don’t move much

- During busy times, prices can move a lot — good for traders

When is Trading Volume High?

- When the London session starts

- During the London – New York overlap

- When both Europe and America are trading

When is Trading Volume Low?

- During late Sydney hours

- Early Tokyo session

- After the New York session ends

The Trading Volume Graph in our tool shows live market activity. It helps traders:

- Avoid slow times

- Trade during busy, active times

- Plan better trades

Best Times to Trade Forex Based on Your Strategy

There’s no one “perfect” time to trade. It depends on your trading style and strategy. Some traders like fast market moves; others prefer slower, steadier times.

Here’s a simple guide for choosing the best times based on your strategy:

1. Scalping or Short-Term Trading

If you love quick trades and fast price movements, trade during the busiest times.

Best times:

- London – New York Overlap

- First 2 hours of the London session

- First 2 hours of the New York session

Pairs & assets to focus on:

- EUR/USD, GBP/USD, USD/JPY

- XAUUSD (Gold) – very volatile during overlaps

- US30, NASDAQ, and S&P 500 indices also see sharp moves

2. Swing Trading (Holding trades for hours or days)

Swing traders prefer strong market moves but don’t need constant action.

Best times:

- Start of London session

- Start of New York session

- When economic news is released

Pairs & assets to focus on:

- Major pairs like EUR/USD, GBP/USD

- Gold (XAUUSD) during major market news

- Indices like US30 for bigger market swings

3. Range Trading (Sideways markets)

When the market is quiet and moving sideways, range traders look for small profits.

Best times:

- Late Sydney session

- Early Tokyo session

- After New York session closes

Pairs & assets to focus on:

- AUD/USD, NZD/USD during quieter Sydney hours

- USD/JPY in quiet Asian times

- Gold and indices are best avoided during low-volume periods

How Daylight Saving Time Affects Forex Market Hours?

Daylight Saving Time (DST) is when some countries move their clocks forward or backward by 1 hour to save daylight. This can change Forex market hours.

Countries that follow DST:

- United States

- United Kingdom

- Many parts of Europe

- Australia (Sydney)

Why DST Matters for Traders:

- Session opening and closing times change by 1 hour

- Overlaps between sessions may shift

- Trading volume may also change timing

But no need to worry! The Forex Market Hours Live handles DST changes automatically. It shows the correct session hours for your timezone, whether DST is active or not.

Best Currency Pairs to Trade in Each Session

Not all currency pairs are active all the time. Some pairs move more during specific sessions. That’s why knowing the best pairs to trade in each session is important. It helps traders focus on the most active markets and avoid quiet times.

Here’s a simple breakdown for beginners:

1. Sydney Session (Asian-Pacific Session)

The Sydney session is usually calm but still offers some good trading opportunities, especially for pairs related to Australia and New Zealand.

Best pairs to trade:

- AUD/USD (Australian Dollar vs US Dollar)

- NZD/USD (New Zealand Dollar vs US Dollar)

- AUD/JPY (Australian Dollar vs Japanese Yen)

If you like trading commodities, XAUUSD (Gold) can sometimes be active during this session, especially when Australian market news affects gold prices.

2. Tokyo/Asian Session

The Tokyo session is when the Asian markets are most active. It’s a great time for trading pairs connected to Japan or other Asian economies.

Best pairs to trade:

- USD/JPY (US Dollar vs Japanese Yen)

- EUR/JPY (Euro vs Japanese Yen)

- GBP/JPY (British Pound vs Japanese Yen)

- AUD/JPY and NZD/JPY also move well

Gold (XAUUSD) often reacts to news from Japan or China, so traders keep an eye on it during this session.

3. London Session

London is one of the busiest sessions, with lots of trading volume. Many major currency pairs are active.

Best pairs to trade:

- EUR/USD (Euro vs US Dollar)

- GBP/USD (British Pound vs US Dollar)

- EUR/GBP (Euro vs British Pound)

- USD/CHF (US Dollar vs Swiss Franc)

- Gold (XAUUSD) – highly active during London hours

Indices like US30 (Dow Jones), NASDAQ, and S&P 500 futures can also be volatile as European traders react to US pre-market news.

4. New York Session

This session brings the US market into play. It overlaps with the London session, creating the most active period of the day.

Best pairs to trade:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CAD (US Dollar vs Canadian Dollar)

- XAUUSD (Gold) – often sees big moves during this session

- US30 (Dow Jones), NASDAQ, and S&P 500 indices are also very active as the US stock market opens

Quick Tip:

If you’re unsure, simply check the Forex Market Hours Live. It shows when each session is open so you can focus on the right pairs at the right time.

Final Thoughts

The Forex market never sleeps, but that doesn’t mean traders need to stay awake 24/7. Understanding forex market hours is key to smart trading — and that’s exactly where our tool, the Forex Market Hours Live helps.

With this easy-to-use tool, traders can:

✔ Check live forex market hours for Sydney, Tokyo, London, and New York

✔ See session overlaps and the best trading times

✔ Get accurate forex market hours in their own timezone

✔ Avoid confusion with Daylight Saving Time adjustments

It’s simple, reliable, and beginner-friendly — perfect for anyone interested in trading Forex, whether they are new or experienced.

FAQs about our Forex Market Hours Tool

Is the Forex market open 24 hours a day?

Yes, but only from Monday to Friday. It starts with the Sydney session on Monday morning and ends after the New York session on Saturday morning (depending on your timezone).

Can I use Forex Market Hours Live on mobile and desktop?

Yes! The tool works perfectly on phones, tablets, and computers. It’s designed to be simple and easy to use everywhere.

Is the Forex Market Hours Live tool free?

Yes, the tool is completely free to use. You can check live Forex market hours anytime.